Menu

- Home

- SUVIDHA

- About Us

- Bilateral Relations

-

Consular Services

-

eMigrate Registration Portal

-

Public advisory

-

Advisory on Scam Telephone Calls

-

Advisory for Indian students coming to Canada for education

-

LATEST ADVISORY ON TOURIST VISA FOR INDIA

-

ADVISORY ON IMMIGRATION INTO CANADA

-

LATEST HEALTH ADVISORY

- Warning for fake/frauds websites for e-Tourist Visa

- New Announcements

- Outsourcing of Consular Services

- CONSULAR ADVISORY ON FAKE CALLS

-

Advisory on overcharging by agents for overseas recruitment, offering fake overseas jobs and illegal recruitment

-

Advisory on Scam Telephone Calls

- General Instructions for Consular Services

- BLS Charges

- Consular jurisdiction

-

Pravasi Rishta Portal

- Attestation/ Legalization of documents

- Passport

- OCI

- Visa

- E-Visa

- Surrender Certificate

- Life Certificate

- Renewal of IDP

- Death of Indian Nationals registered with HCI Ottawa

- PCC

- Misc. Certificates - Ashes, Birth

- Information for Travellers to India

-

Information for Non-Residential Indians and Overseas citizen of India

-

Indian student in Canada can now register on online (Click HERE)

- Registration of birth of a Canada born child of Indian parents

- Voting Rights of Indian citizens living abroad

- Overseas Indian Facilitation Centre – OIFC

- Financial Assistance to Indian Women

- Indian Community Welfare Fund (ICWF)

-

FAQ on Marriages of Indian Women

-

Indian student in Canada can now register on online (Click HERE)

- Indian Community Welfare Fund (ICWF)

- Guidelines for applicants for registering grievance

-

eMigrate Registration Portal

- Pravasi Bharatiya

-

Commerce

-

Indian Business Portal - International Trade Hub for Indian Exporters and Foreign Buyers.

- Tourism in India

- Union Budget 2025-26 and Highlights of Economic Survey

- Business and Investment opportunities in Indian states

- Tenders

-

Public Notices

-

Trade Fairs in India

- Invest India

- Indian Economy

-

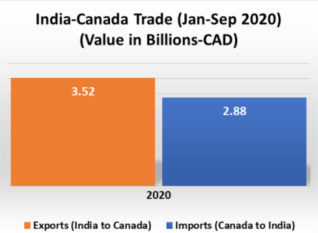

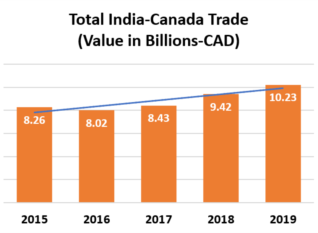

Total Bilateral Trade Country-wise

-

Indian Business Portal - International Trade Hub for Indian Exporters and Foreign Buyers.

- Media/Culture

- Education

- Government of India Links